“Over 500 retail boutiques offer an untold variety of goods and services. Each retail store is individually owned, making New Horizon Mall the most diverse shopping destination in Southern Alberta.”

Unless you have been hiding under a rock for the past few months, you’ve probably already heard about the newly established New Horizon Mall just across from Cross Iron Mills. Indeed, whether you are a mall enthusiast or not, it cannot be denied that this mall is special.

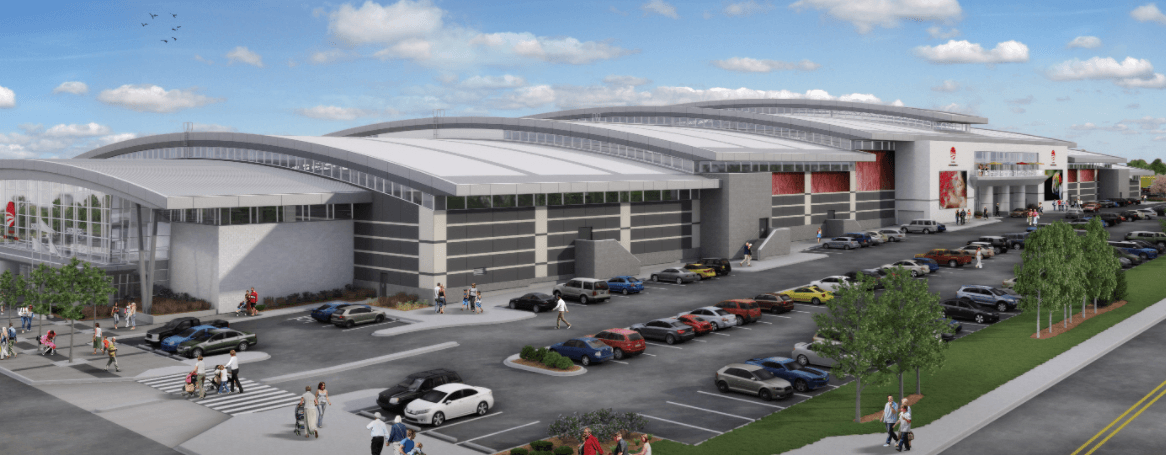

For starters, this mall is HUGE. It is hard not to be impressed by its sheer sized. Developed by Torgan Group and MPI Property Group, New Horizon Mall is a $200 million international shopping mall development. It is Canada’s second-largest mall, accessible to over 1.5 million people within a one-hour drive!

Secondly, most of the stores and restaurants are not the typical big-box store names. Instead, this mall has a multicultural focus, making it more like a modern Asian-style bazaar instead of a traditional North American mall. This means patrons will be able to access a diverse selection of goods and services from all over the world. Given Alberta’s ethnically diverse population, it is likely that this mall has something for every type of consumer.

In addition to the unique shopping opportunities, the mall’s multicultural shopping experience will be matched by entertainment just as diverse, as a main stage will provide a venue for cultural events, holiday celebrations, and fashion shows.

Another great point is that New Horizon Mall will also employ approximately 1,400 people within various positions such as sales, security, and maintenance. This will, of course, benefit Albertans and the overall economy.

In addition, this mall offers great opportunities for small business owners and aspiring entrepreneurs alike. Unlike other nearby major malls, buying or leasing space in this mall is realistic for many people. See below for information about great leasing opportunities!

- Single retail units- rent starting at $799 (only 1 at this price);

- Double size units - rent starting at $1499 (only 1 at this price);

- Triple size units - rent starting at $2499 (only 1 at this price);

* ALL SHOPS SITUATED IN PRIME SPOTS! *

Tenant benefits for signing with us?

- 4 months FREE rent

- Landlord may provide water connection and upgraded electricity (60 amp service) for uses (ex., hair salon, ice cream parlor, etc.)

- Food court units - rent starting at $5000

*** with 3 months FREE rent for period of renovations***

Retail Shop sizes:

145 sqft, 210 sqft, 260 sqft, 290 sqft, 435 sqft *special size (138) sqft

Note: 2+ units can be combined to create a special size for you.

Want to be right by the entrance? Need a unit in the main corridor or by the entertainment area? Don’t care about the location but need something super cheap? We have it all!

Need something in the food court? We have that too.

Let’s get together and discuss your options.

Food Court sizes:

89 sqft (leased), 120 square feet (leased), 260 sqft (1 left), 380 sqft (1 left), 440 sqft (2 left)

If you are a landlord looking to rent your unit, call us today to discuss the available options!

Umair Lasi

403-667-5901

umair@umairlasi.com